What Credit Score Is Needed To Buy A House With No Money Down

Credit scores range from 300 to 850. Lenders offing a fha loan are also restricted in the fees they are allowed to charge you.

Trans Union 8 Top Credit Myths Infographic transunion

While it's possible to get a mortgage loan with bad credit, you typically need good or exceptional credit to qualify for the best terms.

What credit score is needed to buy a house with no money down. It is important to note that you have to pay a very lower down payment with this credit score. If coming up with a down payment is a struggle, an alternative to buying a house with no money down is an fha loan. The minimum credit score required by rocket mortgage® is 580.

Per the fha loan regulations, lenders are allowed to consider candidates with no credit history. Find out how you can buy a house with no money down and a low interest rate. Your credit score is one of the essential elements needing.

Rocket mortgage® requires a minimum score of 580. However, you’ll have to make up for it with a larger down payment if your credit score is lower than 580. If you have a high credit score, it’s probably because you pay back your bills on time and avoid debt as much as possible.

This program allows people with a credit score of at least 700 to get started on the home loan process — with no money down. You don’t need a down payment to qualify for a va loan. Frequently asked question buy a house with no money down payment and bad credit.

The credit score needed to buy a house depends on the type of mortgage loan you're applying for and your lender. Keep in mind that if you make a down payment less than 20%, lenders will probably require you. Thomas claims you can move onto larger buildings if you rent our rooms in your first property credit:

You can boost your credit score by keeping your revolving charge card balances to a minimum and paying all your bills on time. Zero down home loan program: Minimum credit score to buy a house.

To qualify for an fha loan, you’ll need: Minimum 580 credit score, needs 3.5% down payment. Generally, these are the categories you can fall into as a borrower, depending on your credit score:

580 with a 3.5% down payment; If your credit score is between 500 and 579, you’ll be required to put down at least 10%. Minimum 500 credit score, needs 10% down payment.

Credit score requirements when buying a house. No set minimum, but a score of at least 640 is recommended. Buying a house is a big life decision and a complex operation with many important steps.

But the down payment amount may be a little bit high in case you have a lower credit score than 580. All you need is a credit score of 580 to get an fha loan combined with a lower down payment. Most lenders require at least a 620 credit score, but some will allow a score as low as 580.

To be able to put down the minimum 3.5% fha down payment, you’ll need a credit score of 580 or higher. You may be able to get a loan with a credit score as low as 500 points if you can bring a 10% down payment to closing. The minimum credit score needed to get an fha loan is usually around 580.

10% down and a credit score of 500+. You now know that lenders are more apt to grant loans to borrowers with excellent credit. The minimum credit score is 500 with a 10% down payment, or 580 with a 3.5% down payment;

Qualified buyers purchasing homes in designated rural areas. 5% down and a credit score of 580+ (this is the minimum score requirement at quicken loans ®. However, they do allow for loans with a down payment as low as 3.5% of the home’s purchase price.

Fha loans also have additional requirements that must be met for you to qualify for the loan. You’ll need a minimum credit score of 580 to qualify for an fha loan that requires a down payment of just 3.5%. What credit score is needed to buy a house with no money down?

There is no minimum fico ® score, though, to qualify for an fha loan that requires a down payment of 10% or more. This situation falls under the fha. Va loans allow for 100% financing and, according to loan guidelines, no minimum credit score exists.

Fha loans have a minimum credit score of 500 if you make a 10% down payment, or 580 if you.

CollegeGrad GradLoans FirstTimeHomebuyer

Free Excel Monthly Budget Template to Track Cash Flows in

Bad Credit Loans Direct Lender Safety First No credit

What is the minimum Credit Score Needed to Buy a House and

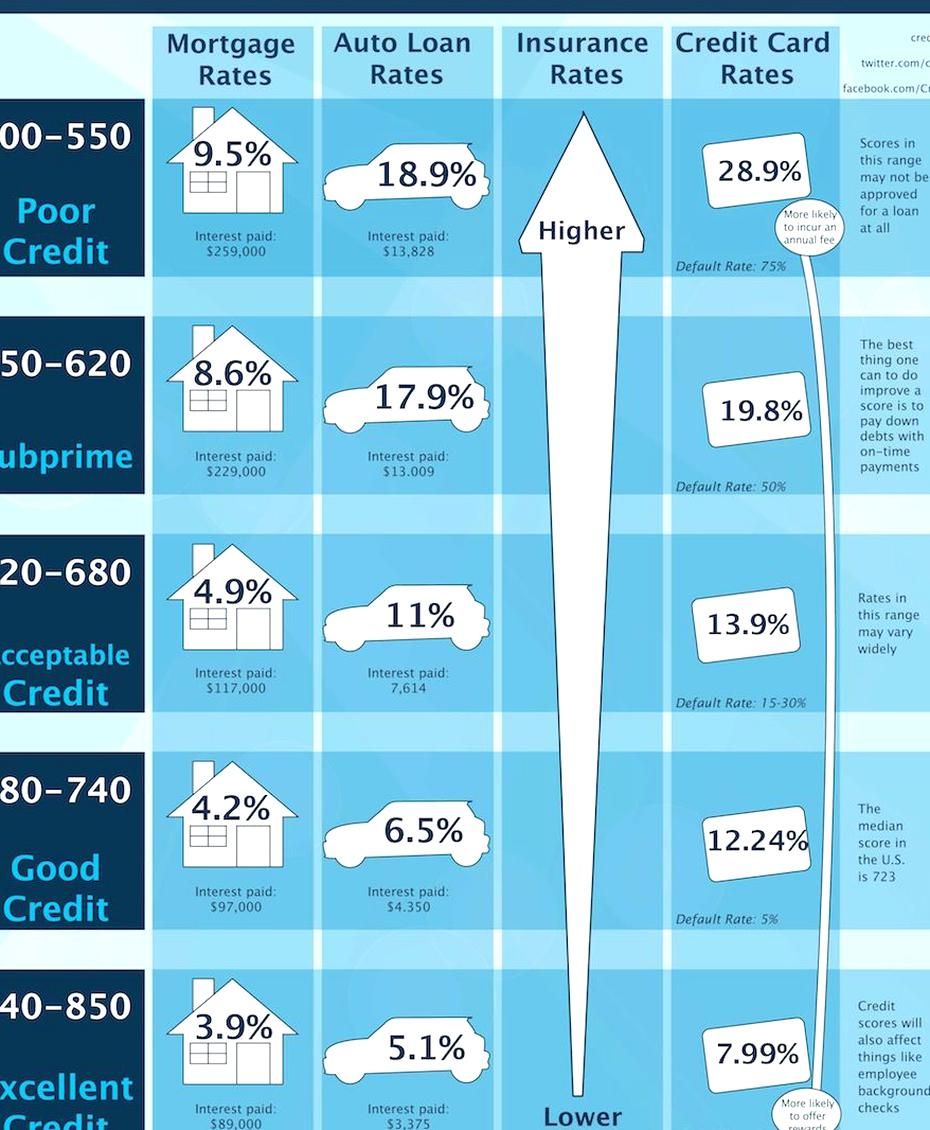

average loan interest rate in 2020 Credit card rates

Help! My Credit Report Dispute Was Rejected Dispute

Kentucky VA Mortgage Lender Guidelines for 2019 Va

Tips on How To Improve Your Credit Score Credit score

Tips for taking out a guaranteed home equity loan for bad

Check your EPF balance now at Financial fitness, Credit

Payday Loans Online Get Smart Financial Solution For

How Do Different Credit Actions Impact Your FICO Scores

Unsecured Personal Loans For Good And Bad Credit Available

Credit Repair Agents needed Credit repair, Best credit

If Your Credit Score is Under 700, Make These 5 Moves ASAP

Online Payday Loans No Credit Check Can Help End All

No Direct Deposit Payday Loans Online Payday loans

How to Get a Personal Loan Personal loans, Payday loans

Comments

Post a Comment